Online banking

Frequently asked questions

How do I register for online banking?

To register your details, please click here or go to www.utbank.co.uk/online-banking-verification.

After you have successfully registered your details, we will email you your username and a temporary password. This email should arrive within a few minutes. If it doesn’t, please check your junk or spam folders. You can then log in to online banking here.

For our Business and Charity customers, we are currently working on an online banking service and, once ready, we will invite you to register.

What do I need to be able to register for online banking?

To register for online banking you will need the following:

• A PC, laptop or tablet equivalent to complete the online registration form

• A mobile phone to allow the Two Factor Authentication process

• The SecurEnvoy Authenticator app (only if you have chosen your method of Two Factor Authentication as ‘Push’)

In addition, during the registration process you will need to provide the following:

• Your full first name and surname, as given in your application

• Your email address as registered with United Trust Bank

• Your National Insurance number

• Your date of birth

• Your United Trust Bank sort code and account number (if you have multiple accounts, you can enter any of the account numbers). The account number you enter must be an active account

• Your Two Factor Authentication preference

• Your mobile number as registered with United Trust Bank

• A memorable word, consisting of at least four characters (case-sensitive)

If you are not sure whether we hold all the information required to register, please contact us to check and we can then update your details if necessary.

I get a message saying you are not able to find my details. Why is this?

This could be for a number of reasons:

• We do not hold one or more of the required details (for example, we may only hold your landline number)

• We do not hold your up-to-date details (for example, if you have changed your email address)

• You have entered some of your details differently to those provided in your application

• The account number you have entered is not an active account with United Trust Bank

• You have not entered the date of birth in the correct format (ddmmyyyy, all as one string of numbers)

If you see this message, we recommend you call us on 020 3862 1268 between 9am and 5pm Monday to Friday.

How do I log in to online banking?

After you have successfully registered for online banking, your username and temporary password will be sent to you by email. This email should arrive within a few minutes. If it doesn’t, please check your junk or spam folders.

Once you have received this, please go to the online banking login screen here and enter your username and password.

Log in

First log in attempt for SMS Two Factor Authentication

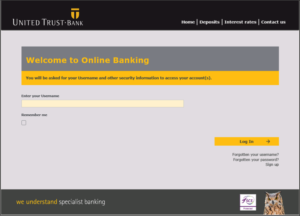

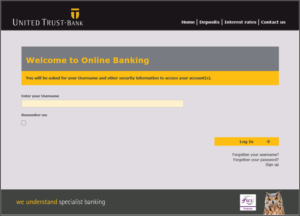

Step 1 Once your username and temporary password have been received, please go to the Online Banking log in screen and enter the details, starting with your username:

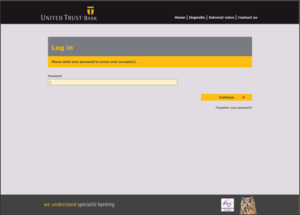

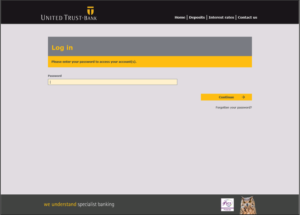

Step 2 Enter your temporary password:

Step 3 Select ‘Continue’ to go to the next screen:

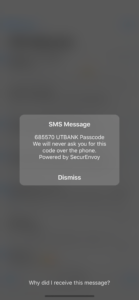

Step 4 You will receive a one-time passcode on your mobile phone:

Step 5 Enter the code on screen and select ‘Continue’:

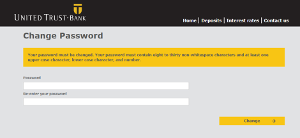

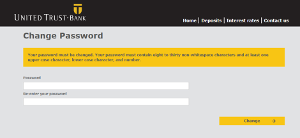

Step 6 The password is required to be changed. Enter your new password and select ‘Change’:

First log in attempt for ‘Push’ Two Factor Authentication

Step 1 Once your username and temporary password have been received, please go to the Online Banking log in screen and enter the details, starting with your username:

Step 2 Enter your temporary password:

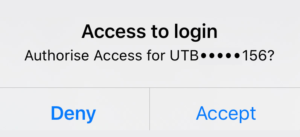

Step 3 You will receive an ‘Auth’ request on your mobile phone. Simply unlock your phone and select ‘Accept’ to progress to the next page:

Step 4 The password is required to be changed. Enter your new password and select ‘Change’:

I have forgotten my username. What should I do?

Please select ‘Forgotten your username?’ underneath the ‘Log in’ button, where you will then need to enter your memorable word, email address and postcode. A reminder of your username will then be emailed to you.

I have forgotten my password. What should I do?

Please select ‘Forgotten your password?’ underneath the ‘Log in’ button, where you will then need to enter your username, followed by your memorable word and email address. A new temporary password will then be emailed to you.

I am not receiving a password reset or username reminder email. What should I do?

Please check that the details you are entering are correct, as you will only receive the email if the information matches what we hold for you. If you do not receive an email from us, please call us on 020 3862 1268 between 9am and 5pm Monday to Friday as we may need to reset your details instead.

How do I change my password?

To change your password, select ‘My Details’ and ‘Online Security’ from the left side menu within Online Banking. You will be able to enter your new password and will be prompted to re-enter it to confirm that the passwords match. Please ensure that the new password is a unique and new password and not the same password as you are currently using. Once you are happy with your choice, select ‘Change password’ and this will carry out your request.

If you have forgotten your password, please see I have forgotten my password. What should I do? to find out what actions you need to take. If you think somebody may know your password or log in details, please contact the Deposits team on 020 3862 1268 between 9am and 5pm Monday to Friday.

Can I change my username?

No. Your username is created automatically as a unique identifier for you, and it cannot be changed.

If you think somebody may know your username, please contact the Deposits team on 020 3862 1268 between 9am and 5pm Monday to Friday.

Can I change my memorable word?

To change your memorable word, select ‘My Details’ and ‘Online Security’ from the left side menu within Online Banking. You will be able to enter your new memorable word and will be prompted to re-enter it to confirm that the memorable words match. Once you are happy, select ‘Change memorable word’ and this will carry out your request.

What is two factor authentication (2FA)?

When signing up for Online Banking, you can decide whether to use Push or SMS notifications for Two Factor Authentication (2FA). 2FA means using a second mechanism (in each case via your mobile phone) to verify your identity. In both cases, a mobile number is required and must be registered with United Trust Bank.

Once registered with either method, your username and a temporary password will be sent to your registered postal address. You will be asked to change your password upon your first log in.

Push notifications

With push notifications, whenever you log in to Online Banking or make any changes to your account via Online Banking, you will be prompted to complete authorisation via an app on your phone. United Trust Bank have partnered with SecurEnvoy for this purpose, and to use push notifications you will need to download the SecurEnvoy Authenticator app to your phone for iPhone or Android from the relevant app store.

During the sign up phase, you will receive an activation email to your registered email address with an activation code. You will be prompted to enter the code into the next screen. Once this has been accepted, a QR (Quick Response) code will appear on the screen and will need to be scanned using the ‘Scan QR’ option on the SecurEnvoy app, after selecting the ‘+’ button. You will then be set up to use push notifications for Two Factor Authentication.

SMS notifications

If you choose SMS notifications, no further set up is required. Thereafter, whenever you log in to Online Banking or make any changes via Online Banking, you will be prompted to complete authorisation using a one-time passcode sent by SMS to your mobile device.

How do I check the balance on my account(s)?

Log in to Online Banking and select ‘Accounts’ for an overview of your balances. Select individual accounts to view transactions relating to each account.

How do I find the interest rate for my account(s)?

To check the interest rate on your account(s), log in to Online Banking and select ‘Accounts’ and then select the account you wish to see.

How do I request a withdrawal or place notice on my account(s)?

To submit a withdrawal request or place notice, please log in to Online Banking and select ‘Messages’ to send us a secure message with your request.

You will only be able to place notice on a Notice Account you have opened with us. The notice period that applies to your account will need to be seen through to its expiration date, before we then transfer the requested funds to your nominated bank account by Faster Payment.

If you hold funds in a Call Account, you will be able to make a request for an immediate withdrawal to your nominated bank account, in line with our terms and conditions. Please either send us a secure message or contact us here with your request.

How do I view my statements?

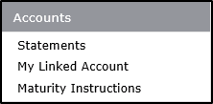

To check your statement, log in to online banking and select ‘Accounts’. Select your chosen account and the ‘Statement’ option on the left side menu. You will be able to locate your statements if they have been produced.

How do I change my interest preferences?

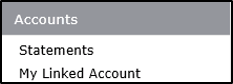

In Online Banking, select the account you wish to update and then select ‘My Linked Account’. Here you have the option to compound interest or to have it paid to your nominated bank account. Please note, you are only able to have interest paid back automatically if you have a Notice Account or a Fixed Term Bond over one year.

You will need to ensure you have selected a linked account to make any payments to your nominated bank.

How do I give you my maturity instructions via online banking?

Click here to watch our video guide on how to submit your maturity instructions online.

14 days prior to your maturity date, we will send an SMS notification to your registered mobile phone to advise you that you are able to provide maturity instructions online.

We will also send you an email with a secure link to your maturity form outlining your options. You will need to provide a few characters of your National Insurance number for security before being able to view the document. Please ensure you check your junk or spam folder in case our email arrives there.

To give your instructions within 14 days of maturity, please locate the account(s) that is/are due to mature.

Step 1 Click on the account number that is due to mature, then select ‘Maturity Instructions’:

Step 2 Select ‘Add’ and you will be able to provide your maturity options. As you build your instructions, a summary of your choices will be available to review:

Step 3 Once you are happy with your selection(s), select ‘Complete Instructions’. Please note, you will need to provide instructions for the total balance at maturity. Instructions will not be saved until the total balance has been accounted for.

In addition, if you do not complete the instructions, they will not save and you will need to re-enter them:

Step 4 Should you wish to make any withdrawals to your nominated bank account, you will need to ensure that the account has been linked. To do this, please select ‘My Linked Account’, select the account you wish to link and select ‘Save’. Once the account has been linked, the funds will only be remitted to the linked account:

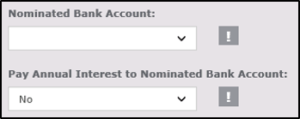

How do I view, add or cancel the details to use for my nominated bank account?

To view, add or cancel a nominated bank account, log in and select the ‘Nominated Bank Account’ option on the left side menu.

Should you wish to add a new nominated bank account, select ‘New’ and provide the new bank details. You will then need to link the new details to the relevant account number within the ‘My Linked Account’ option. Please note, you will need to remove the existing link before you can link your new nominated bank account.

Should you wish to cancel the nominated bank account, select the respective details you would like to remove and click ‘Cancel’.

Please note, you will need to remove the link from the ‘My Linked Account’ option on each of your accounts before you can cancel the nominated bank account.

A nominated bank account is a transactional UK bank account, where electronic payments can be sent or received. You must provide one as part of your application, and any funds you send to us must be sent from the bank you have nominated. Each customer is only allowed one nominated bank with United Trust Bank.

How do I change my mobile security setting?

To update your Two Factor Authentication (2FA) preferences, select ‘My Details’ and ‘Mobile Security’.

If you currently have SMS notifications and wish to opt for Push Notifications, you will need to download the SecurEnvoy Authenticator app from a relevant app store and proceed with Push Notification enrolment. An email will be sent to your registered email address with a one-time code to input on screen. To complete registration, scan the QR code when prompted using the SecurEnvoy Authenticator app.

If you currently have Push notifications and wish to opt for SMS Notifications, you will receive a one-time code and you can then proceed to enrol for SMS notifications.

How do I change my personal details?

You can change your address and contact details via Online Banking. Once you have logged in, please select ‘My Details’ then ‘Change Contact Details’. Select the relevant option(s) to change your details accordingly. You will receive a Two Factor Authentication notification to approve the change.

To change your email address, please send us a secure message.

How do I access secure messaging?

Should you wish to send us a message, log in to Online Banking and select ‘Messages’. This allows the contact between you and United Trust Bank. Please note, should you wish to send additional funds for your maturing bond, we require a ‘Top Up’ message to inform us that funds are on the way.

How do I open a new account via online banking?

To open an additional deposit account online, please select ‘New Application’. The account application will then start in a new window. You will be able to select from the Fixed Term Bonds or Notice Accounts available.

Your information will be pre-filled based on the details we hold for you. If your details require updating, please close the application window to take you back to Online Banking where you can make the necessary changes before proceeding with the new application.

How do I check or reject an action on my joint account?

If a joint account requires more than one signatory to complete an instruction, both parties will be required to authorise any amendments made via Online Banking.

Either party will be able to log in to Online Banking, if registered, and submit a request. This will prompt a Two Factor Authentication (2FA) response and the request will be held as ‘Pending’. A request will not be fully approved until the joint party logs in and actions the request via the ‘Authorisation’ menu on the left side.

The joint party will be able to ‘Reject’ or ‘Approve’ the request. Once the ‘Approve’ option has been selected this will prompt a Two Factor Authentication (2FA) response.

I was unable to provide instruction on some of my accounts. Why?

At present, you will not be able to provide us with your maturity instructions if your funds are held in any of these account types:

7 Day Instant Access Account

ISA Fixed Term Bond

ISA Call Account

Should you wish to provide us with a withdrawal instruction for one of these accounts, send us a secure message using Online Banking. Alternatively, you can use the contact form, or call us on 020 7190 5599 between 9am and 5pm Monday to Friday.